Today is a good day for MuesliSwap, a good day for the DJED protocol, and a good day for DeFi on Cardano.

MuesliSwap has a unique opportunity to capture market liquidity for its iUSD/DJED pair, attract traders, and become the largest DEX in the Cardano ecosystem.

The Problem:

Currently, the DJED protocol has reserves below 400%, which prevents the minting of DJED by providing the equivalent amount of ADA to 1 dollar (+ fees).

Currently, the synthetic asset iUSD is priced at $1.02, and the over-collateralized stablecoin DJED is priced at $1.10, with the following price variations over the past 20 days, according to Coinmarketcap:

iUSD

Minimum: $0.9846 (28/06/2023)

Maximum: $1.0594 (20/06/2023)

DJED:

Minimum: $1.0175 (23/06/2023)

Maximum: $1.1362 (21/06/2023)

But shouldn’t stablecoins be priced at around $1 all the time?

Let’s see what happened with DAI, from MakerDAO, during the same 20-day period:

DAI

Minimum: $0.9983 (26/06/2023)

Maximum: $1.001 (22/06/2023)

Why is this happening with iUSD and DJED?

The simple answer:

Due to supply and demand, which is influenced by the AMM algorithm, arbitrage between AMM DEXs and stability pool DEXs, and arbitrage between DEXs and the Bitrue CEX (the only one that has listed DJED so far). Combined with the impossibility of minting DJED at $1 in the protocol itself (reserves below 400%).

The critical and proactive answer:

Due to the absence of a concentrated liquidity range between $0.99 and $1.01, and the absence of liquidity on the MuesliSwap DEX, which is the only one that features concentrated liquidity among all Cardano DEXs (market differential).

What is the liquidity problem on MuesliSwap?

It lacks incentives for liquidity providers beyond trading fees, which currently amount to:

Trading Fee APR: 0.07%

Liquidity Locked: 207,109 ₳ (~$59,608)

The absence of these incentives is a healthy factor for the platform’s tokenomics but equally catastrophic for attracting liquidity providers.

Compared to all other competing DEXs, which offer token reward incentives, MuesliSwap fails to attract liquidity to the protocol, despite being one of the most innovative in Cardano’s DeFi space.

The Solution:

1. Create a liquidity range for the IUSD/DJED pair between $0.99 and $1.01:

-

It will attract all traders who prefer not to acquire DJED with a 7% to 10% premium because it is expected that at some point the stablecoin will return to its correct price, either by reopening the minting of DJED in the protocol or by another competing DEX implementing concentrated liquidity.

For example, if in all DEXs, when exchanging iUSD for DJED, I receive $0.95 DJED, but on MuesliSwap, I receive between $0.99 and $1.01, I will prefer to trade on MuesliSwap. -

It will substantially increase trading fees, attracting more liquidity providers interested in obtaining real APR gains instead of inflationary tokens from other DEXs.

But isn’t this similar to what we have today?

Yes, we come back to the question of what comes first, the egg or the chicken… in other words, should liquidity providers or traders come first?

The answer is intuitive: Liquidity providers need to come first to reduce price impact, slippage, and allow trading within the desired price range for traders.

For this reason, this proposal outlines the following strategy to solve the initial liquidity problem:

2. Allocate x% of the $MILK tokens from the treasury to distribute as an airdrop to liquidity providers of the IUSD/DJED pair within the liquidity range of $0.99 and $1.01 for 7 days.

The decision on the amount of tokens to be distributed should be based on a technical assessment by the team regarding a healthy and strategic limit for the treasury’s reserves.

As a proposal based on game theory, I suggest a real yield for the airdrop over 7 days equal to the difference in price between DJED and $1, which is currently 10%. Therefore, a suggested APY of 616.72% on a token amount representing the desired TVL (Total Value Locked) in the pair.

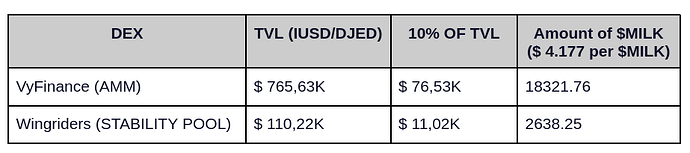

Simulation comparing the TVL of the IUSD/DJED pair on other DEXs to obtain the 10% token amount in $MILK tokens:

Therefore, to become the leading DEX in TVL for the iUSD/DJED pair, at least 18k $MILK tokens would need to be distributed in the airdrop.

This airdrop will occur separately from the platform, on a specific claim page where liquidity providers will connect their liquidity-providing wallets, access the token quantity, and send a 2 ADA deposit UTXO to receive the tokens in a multi-signature transaction, with the fee paid by the user.

A vesting period of 6 months should be implemented for the release of the airdrop, with monthly releases of approximately 16.66% starting from the first month. This is a way to mitigate the potential negative effect of token selling.

Conclusion:

This exception to the rule, which is the stimulus through token distribution for a very short period of 7 days, will attract initial liquidity. After this period, high fees will be generated by traders, representing a real (in dollar terms, not in tokens) gain APY higher than any other Cardano DEX.

The cost of not implementing this proposal is to miss a unique opportunity to position MuesliSwap as a mature DEX with high user adoption and place it ahead of competitors that will come in the coming months with concentrated liquidity models, such as Genius Yield and Axo Trade.

- Translated by ChatGPT.

2023-07-10T03:00:00Z