![]() question

question ![]() so now that we have the hungry cows nfts with the guaranteed boost amount attached to them have the developers thought about creating a dashboard for all the users of the Dex to sign in with and attach their wallet, and the dashboard could have a place for excess hungry cows to be staked and after staking those hungry cows that are not being utilized you can make those cows percentages available to the users of the dex and they can pay a fee for the percentage guarantee/lock in, and you could take all of the staked hungry cow nfts and batch them in groups example s like 7% to 12% for 10ada, 13% to 15% for 12 Ada, 15% to 20% for 17 Ada, and charge different values of ADA to lock in that nft for a per epoch fee of that guaranteed percentage, and when they pay as an example 23.5 Ada for the 20% to 25% range if there are 40 nfts staked in range from 20 to 21 to 21.5 to 23 to 24.06 to 25.49 the individual who pays the Ada for a guaranteed percentage will fall within that range and they will be assigned that nft for that one epoch.

so now that we have the hungry cows nfts with the guaranteed boost amount attached to them have the developers thought about creating a dashboard for all the users of the Dex to sign in with and attach their wallet, and the dashboard could have a place for excess hungry cows to be staked and after staking those hungry cows that are not being utilized you can make those cows percentages available to the users of the dex and they can pay a fee for the percentage guarantee/lock in, and you could take all of the staked hungry cow nfts and batch them in groups example s like 7% to 12% for 10ada, 13% to 15% for 12 Ada, 15% to 20% for 17 Ada, and charge different values of ADA to lock in that nft for a per epoch fee of that guaranteed percentage, and when they pay as an example 23.5 Ada for the 20% to 25% range if there are 40 nfts staked in range from 20 to 21 to 21.5 to 23 to 24.06 to 25.49 the individual who pays the Ada for a guaranteed percentage will fall within that range and they will be assigned that nft for that one epoch.

Additionally if they want to extend the locked in guaranteed boost they can do a drop-down box choice of up to six epochs which should be 30 days and pay the fee and they’re locked in for that month on the nft boost. With that the payout could go to one big treasury specifically for the boost providers and they could receive token payments through a percentage of the boost usage on the Dex (ie. 2.5%) and the rest goes to the muesli swap project R&D. This this would provide a secondary utility for the nft and also benefit the greater community of the muesli swap Dex users as well as the utility NFT holders …add value, and with it being able to be a guaranteed range value they can get anywhere from the lowest to the highest based off of a randomly generated number lottery system of whatever nfts are still open within that range of percentages and adding in the per epoch payment that would deter big time whales from hogging a 90% or a 75% nft and after the original contract is expired that nft can go into a cool down period of one epoch, that way the whales or the greedy can’t go back in and grab that same one, thus the reason for the randomly generated range finder so to speak. ![]() … This idea has been bothering me for a while I didn’t know where else to put it and I didn’t know if anybody ever brought it up but I’ll just leave this right here thank you for reading if you did I’m sorry it was so long…

… This idea has been bothering me for a while I didn’t know where else to put it and I didn’t know if anybody ever brought it up but I’ll just leave this right here thank you for reading if you did I’m sorry it was so long… ![]() Good Moooo ning

Good Moooo ning ![]()

![]()

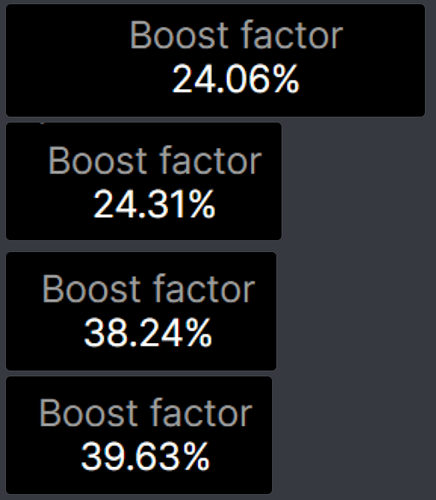

So this bundle is just my attempt at an info graphic

So we can say we have 1 bundle or 2

I will go with 1 for this idea

we have a range of boost for 4 NFTs … 24% to 39% the extra decimals can be lagniappe (extra). So you can guarantee a boost of between 24 -39 for say 30 ADA

the more NFTs in that range can adjust the price like the more 24s you have the 30ADA can be lowered due to supply being more abundant on lower end of the bundle range… Ie. 27.55 ADA

Anyway the payment to lock in is 30 ADA and is including the 1st epoch (5 Days) …

Any additional epochs incur a charge up front ie. 10 ADA per additional epoch lock up. up to 6 epochs (30 Days)

Now Example Two… is the same just with two different tiered prices per block…

24 % boost 22 ADA

38-39 % boost 35 ADA

and you can apply that to

12.43 % - 17.59% = 15 ADA cost ,

18% -23.59% = 20 ADA cost

25.13%-30.65% = 28ADA Cost

39.25% - 45.89% = 42ADA Cost

etc…

Example 1.5 percent of locked up NFT boost usage yield (for every 100x earned from Boost guarantee sales, Boosters get 1.5x in the boost provision pot) can go to the NFT Boost Providers and the R&D side of Muesli gets the rest to build and reward the DEX users and MILK holders etc.

What do you think?

JUST ONE MORE THING…

Once you get the Code written out you can partner with the wallet providers to connect directly and the token claiming by the boost providers and HUNGRY COW STEAKING ![]() can occur within wallet … directly like make the wallets the dashboard kind of … with features for muesli DEX

can occur within wallet … directly like make the wallets the dashboard kind of … with features for muesli DEX

Less like a plugin than a DEX assimilation with HUNGRY COWS

LATE ADDITION:

This Particular idea could be a Killer DEX feature that could make Muesli stand way out… Guaranteed Boost. And based off of metrics limit certain yield usages to special events like the 80%-90% only during Spring and Summer markets and during winter Retire them… Just an example… as well as Short TERM Boosting Guaranteed 72 hr Boosting Instead of Full on 5 days (epoch) Smart/Contract Timer Im guessing …